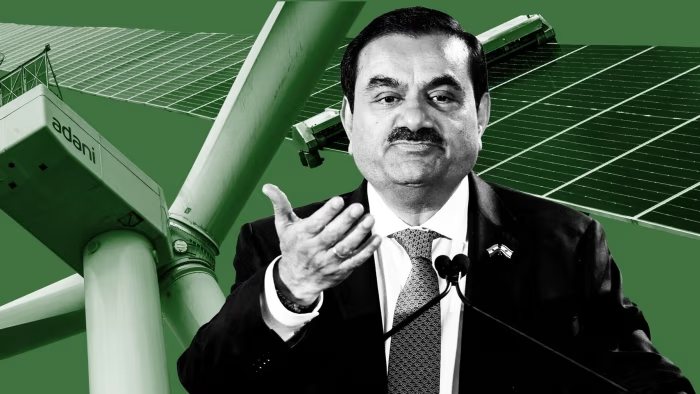

Adani Saga: Beyond the Obvious

While the latest SEC charges against Adani merit investigation, the issue goes beyond what meets the eyes immediately. Geopolitics and national reputation being at stake, for instance. — KK Srivastava

The narrative seems very familiar. Media breaks bad news for Adani group, the group denies charges, politics goes on overdrive, even Parliament is disrupted. But times have changed. Earlier the accusations, unproved, came from a private analyst firm, Hindenberg. Now the charges are levied by SEC, America’s powerful market regulator; it has bigger potential impact. Already, Adani’s partners, financers, and even governments have sought to review their relations with the group. Besides, the charges now are bribery and false declaration; this can have, if proven that is, more potential damaging effect than now dismissed, private allegations of round tripping money for boosting group stocks. Incidentally Adani is not alone; many big corporate names – Siemans, Petrobras, Haliburton.... have had an adverse engagement with SEC. But for a multi country conglomerate like Adani, with ever rising ambition and footprints globally, this certainly does not augur well. Funding will suffer, for one, for a company that invests in capital intensive projects. Incidentally Trump 01 had wanted to scrap the Foreign Corrupt Practices Act since it, according to him, hurts American companies doing business abroad. It is to be seen what stand Tramp 02 takes. The pattern remains simple. Allegations, sometimes true and other times unproven, fly high all the time that businesses seek to game a (in theory) a rule based system which (in practice) the politicians and bureaucrats mould, for a consideration, in favour of capitalists. The incentives on both sides being mouth drooling, the game will continue to be played, notwithstanding a conviction here or there.

The charges, yet unproven, need to be taken seriously. The Adani group is among the top 3, Ambani, Adani, and Tatas. What happens to it affects the stock market and the broader economy. All the concerned regulators now need to investigate the allegations raised in a transparent and time bound manner. A BJP spokesperson’s claim that all this could be a part of geopolitical dynamics - an issue we will examine later in the piece- could very well be a true allegation that there is an attempt by powerful forces to undermine India’s economic advancement; yet, an investigation is a must.

Let’s focus on bigger canvass than merely on Adani saga.

For one, the present controversy will act as a marker for India Inc’s global ambitions; these could hit a barrier against imperfectly designed and non harmonized regulations and variance in law enforcement. Assuming that minimum standards of law are met for individual jurisdictions, corporations will have to design and execute the acceptable corporate governance norms. Competition being fierce and cut throat both in same breath, a multi nation operation can survive only if you excel at entrepreneurship, Innovation, and governance - this is the required clause for gaining access to markets and finance. And yet, the chances of default grow with the diversity of business environment an entity encounters, be these governance or green norms. You have to be sensitive to each new market you enter; there are no common set of rules, laws are enforced with varying degree of strictness, violations may or may not be condoned depending on field of operation. And to top it all the business environment- dictated by political and economic forces- is very dynamic. Witness Trump 02 era and possible changes, including the foreign corruption Act. It is impossible for businesses to keep pace with new evolving structures and timelines. And yet abide they must to prevent running afoul of regulation and laws. Business has to be culturally flexible, adaptable, and consequently attuned to adopt new values that are needed for operating successful in international arena.

Good corporate citizenship is based on twin factors, doing it right and communicating it effectively to stakeholders, including consumers, invertors, regulators, and all else.

Second, for all we know the Adani group may come out unscathed from the accusation. Indeed, as we said earlier, it remains an open question if Trump implements the changes he has promised once he occupies the President’s seat. Yet, until that happens, the group will suffer the ignonimity. Especially because it works in sectors where the ability to raise money and tackle political adversity is a must. But more importantly, the controversy is a matter of national concern since the reputational damage transcends merely the Adani group. For instance, others would also seek market and capital abroad; Vedanta has already paused a planned dollar bond sale. Thus it is essential to restore faith in the Indian corporate system and its fair functioning. No disclosure gaps, for Instance, can be permitted. So the incidence must be thorougly probed by Indian authorities too. Else, trouble in one group can affect the bigger Indian story.

Finally, the issue of alleged geopolitical dynamics. Some political analysts have opted to highlight certain regulatory decisions in the background of recent developments in global geopolitics. It is certain that Trump will replace certain key attorneys, including, allegedly, the attorney handling the arraignment of Adani. These replacements, according to some observers, coincide with increased scrutiny of select international businesses. So there is a whisper that Adani’s energy business is being put in the dock since the project challenges Chinese dominance in the global markets. The question therefore is: Was it a targeted attack? It is true that Adani’s, investments, when fructified, will go a long way towards cementing India’s energy security by reducing reliance on imported fuel. This will affect the global energy leaders adversely since their competing Interests will suffer. Incidentally, Azure, the whistleblower, is a direct competitor to Adani; it is reportedly backed by foreign investors. For all one may know - but not established - that Azure may be involved in game of blame shifting on to a soft target. This context raises questions about the impartiality of the allegations.

Most crucially it is imperative to distinguish between allegation and proven fact. Many such accusations in the past have culminated into no criminal conviction even after lengthy investigations. For example, Google and Meta have not faced much repercussions despite intense scrutiny. Certainly actions, like the present one, demonstrate regulatory vigilance but they often lack conclusive outcomes.

Interestingly, but perhaps not intriguingly, a notable disparity exists while dealing with Chinese business. This in face of well highlighted concerns relating to intellectual property theft, market dominance, global surveillance, and other charges against Chinese businesses. Questions then arise whether the enforcement is applied uniformly, consistently, and without bias against all global players irrespective of their country of origin. Equitable treatment should be a norm, but perhaps is not presently, in order to ensure spirit of innovation and healthy competition.

The norms for being a global corporate citizen must be applied yes, but uniformly across all corporations and all nations. In the long run this will make a better sense, economically - if not necessarily politically!