Budget is forward note for Vikasit Bharat

Budget also focuses on manufacturing to empower entrepreneurs, MSME and Small business to fulfill the aspirations of 140 crores of Bharatiyas. —Mahadevayya Karadalli

Bharat has completed the first quarter of the 21st century and it is pleased to record that our economy is the fastest-growing among all major global economies. During this decade nation’s development track record and structural reforms have drawn global attention.

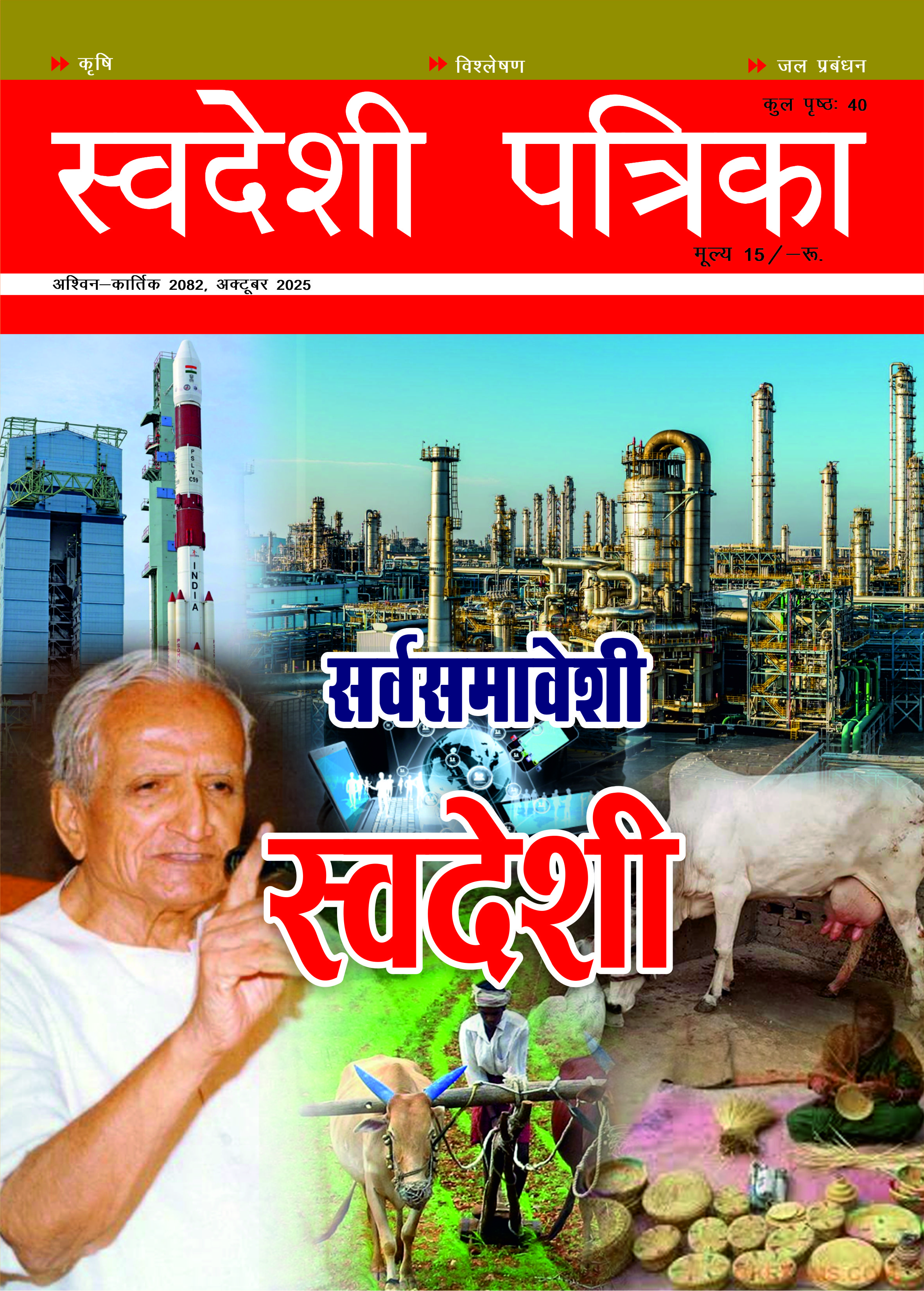

The great Telugu poet and playwright Gurajada Appa Rao had said, ‘A country is not just its soil, a country is its people.’ In line with this, Viksit Bharat, encompasses: zero-poverty; hundred per cent good quality school education; access to high-quality, affordable, and comprehensive healthcare; hundred per cent skilled labour with meaningful employment; seventy per cent women in economic activities; and farmers making our country the ‘food basket of the world’. To achieve development Central government’s four powerful development engines are: Agriculture, MSME, Investment, and Exports. To reach the destination: Viksit Bharat the avenues are Reforms, guiding spirit and Inclusivity. This Budget aims to initiate transformative reforms across six domains. Viz. Taxation; Power Sector; Urban Development; Mining; Financial Sector; and Regulatory Reforms.

Agriculture as the 1st Engine. Prime Minister Dhan-Dhaanya Krishi Yojana - Developing Agri Districts Program, Building Rural Prosperity and Resilience, Aatmanirbharta in Pulses, Comprehensive Program for Vegetables & Fruits, National Mission on High Yielding Seeds, Mission for Cotton Productivity are special areas identified to strengthen economy. Enhanced Credit through KCC and India Post as a Catalyst for up liftment of the Rural Economy.

MSMEs as the 2nd Engine, Government proposed to set up a National Manufacturing Mission covering small, medium and large industries for furthering “Make in India” by providing policy support, execution roadmaps, governance and monitoring framework for central ministries and states. Currently, over 1 crore registered MSMEs, employing 7.5 crore people, and generating 36 per cent of our manufacturing, have come together to position India as a global manufacturing hub. With their quality products, these MSMEs are responsible for 45 per cent of our exports. To help them achieve higher efficiencies of scale, technological upgradation and better access to capital, the investment and turnover limits for classification of all MSMEs will be enhanced to 2.5 and 2 times respectively. This will give MSMEs the confidence to grow and generate employment for our youth. The details include Significant enhancement of credit availability with guarantee cover, Credit Cards for Micro Enterprises, Fund of Funds for Startups, Scheme for First-time Entrepreneurs, Measures for Labour-Intensive Sectors, Focus Product Scheme for Footwear & Leather Sectors.

History reveals that before advent of Muslim and Britisher since centuries, Bharat was leader of world market in leather business. To revive and to enhance the productivity, quality and competitiveness of India’s leather sector, a focus product scheme will be implemented. The scheme will support design capacity, component manufacturing, and machinery required for production of non-leather quality footwear, besides the support for leather footwear and products. The scheme is expected to facilitate employment for 22 lakh persons, generate turnover of 4 lakh crore Rupee and exports of over 1.1 lakh crore Rupee.

Investment as the 3rd Engine, which encompasses investing in people, investing in the economy and investing in innovation. A game changing thought i.e. investing in people to increase productivity mentioned. So, Atal Tinkering Labs Bharatiya Bhasha Pustak Scheme, National Centers of Excellence for Skilling, Centre of Excellence in AI for Education Day Care Cancer Centres in all District Hospitals etc., became the part of the budget. Strengthening urban livelihoods Investing in the Economy Public Private Partnership in Infrastructure Jal Jeevan Mission Nuclear Energy Mission for Viksit Bharat Investing in Innovation Research, Development and Innovation PM Research Fellowship Gyan Bharatam Mission are proposed to achieve Vikasit Bharat.

Exports as the 4th engine - Export Promotion Mission – An Export Promotion Mission will be setup with sectoral and ministerial targets, driven jointly by the Ministries of Commerce, MSME, and Finance to facilitate easy access to export credit, cross-border factoring support, and support to MSMEs to tackle non-tariff measures in overseas markets.

A digital public infrastructure, ‘Bharat Trade Net’ (BTN) for international trade will be set-up as a unified platform for trade documentation and financing solutions. This will complement the Unified Logistics Interface Platform. The BTN will be aligned with international practices. Support for integration with Global Supply Chains. National Framework for GCC a national framework will be formulated as guidance to states for promoting Global Capability Centers in emerging tier 2 cities to leverage this opportunity for the benefit of the youth.

Reforms as the Fuel Tax Reforms - Government has implemented several reforms for convenience of tax payers, such as (1) faceless assessment, (2) tax payers charter, (3) faster returns, (4) almost 99 per cent returns being on self-assessment, and (5) Vivad se Vishwas scheme. Financial Sector Reforms and Development.

Pension Sector - A forum for regulatory coordination and development of pension products will be set up is the good move towards welfare of Penisoners.

For the insurance sector the FDI limit will be raised from 74 to 100 percent. This enhanced limit will be available for those companies which invest the entire premium in India. The current guardrails and conditionality’s associated with foreign investment will be reviewed and simplified.

Grameen Credit Score KYC Simplification - the revamped Central KYC Registry will be implemented with a streamlined system for periodic updating.

Indirect Taxes

Budget aims to rationalize Customs tariff structure and also support domestic manufacturing and value addition, promote exports, facilitate trade and provide relief to common people. As a part of comprehensive review of Customs rate structure, remove seven tariff rates. This is over and above the seven tariff rates removed in 2023-24 budget. After this, there will be only eight remaining tariff rates including ‘zero’ rate. Budget proposed to apply appropriate cess to broadly maintain effective duty incidence except on a few items, where such incidence will reduce marginally and also levy not more than one cess or surcharge.

Relief on import of Drugs/Medicines

To provide relief to patients, particularly those suffering from cancer, rare diseases and other severe chronic diseases, FM proposed to add 36 lifesaving drugs and medicines to the list of medicines fully exempted from Basic Customs Duty (BCD). Further, to give boost to Critical Minerals Textiles, Electronic Goods Lithium Ion Battery Shipping Sector Social Security Scheme for Welfare of Online Platform Workers.

An initiative to Support to States for Infrastructure is in the form of an outlay of 1.5 lakh crore Rupees is proposed for the 50-year interest free loans to states for capital expenditure and incentives for reforms.

Considering aspirations of states due for election is necessary for party in power. At the same time Government has to take into considerations of demands of voters of other states who have voted for the party in power. For example for Karnataka State it is very much needed to Create Railway Division at Kalaburagi, Starting AIMs at Kalaburagi and Raichur.

Let us conclude with Prime Minister remark, that this budget focused on how to fill the pockets of the citizens rather than focused how to fill the Government Treasury. Increase their savings, and make them partners in the country’s development. He emphasized that this budget lays the foundation for these goals. “Significant steps have been taken towards reforms in this budget.” This budget not only addresses the current needs of the country but also helps in preparing for the future.

PM highlighted the initiatives for startups, including the Deep Tech Fund, Geospatial Mission, and Nuclear Energy Mission. He extended his congratulations to all citizens for this historic budget. Budget will tried its best to empower every citizen, agriculture sector, and give boosts to rural economy. Budget proposals benefit the middle class. Budget also focuses on manufacturing to empower entrepreneurs, MSME and Small business to fulfill the aspirations of 140 crores of Bharatiyas.