India’s Manufacturing and Progress

India strives to be the third largest economy soon and developed nation by 2047. Manufacturing sector has to contribute with full force towards achieving the milestone. — KK Srivastava

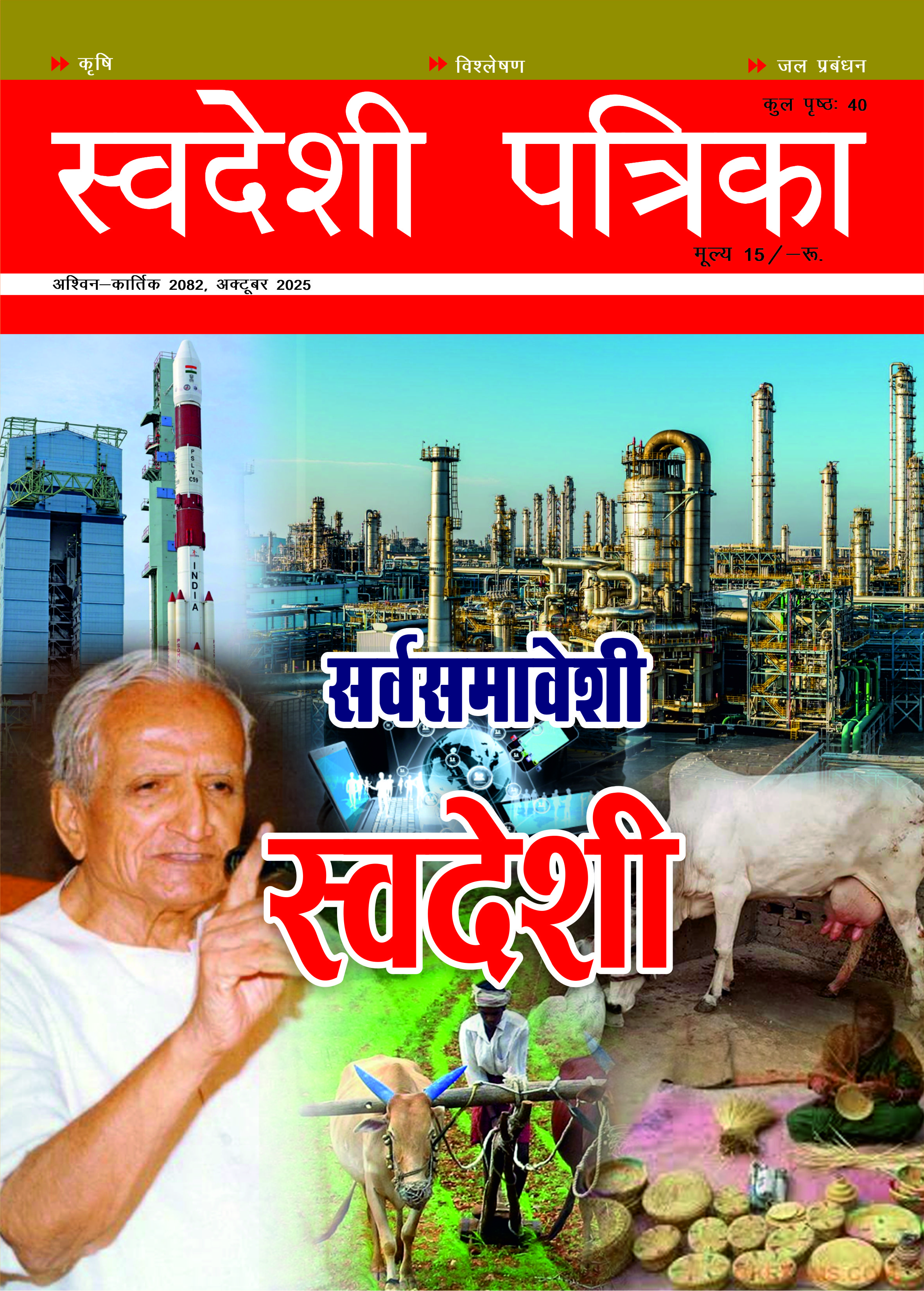

India aspires to become the third-largest economy and a developed nation by 2047. For this goal to be realized, the manufacturing sector must play a pivotal role. While manufacturing activity has seen an increase since the launch of the “Make in India” initiative, the sector, a cornerstone of India’s economic growth, is showing signs of slowing down, raising concerns about the broader economy’s future trajectory. Additionally, India’s integration into Global Value Chains (GVCs) presents certain challenges. Trade related to GVCs, which reflects a nation’s participation in multistage trade processes, accounts for over 50% of gross trade in manufacturing.

Here’s a sectoral breakdown of GVC-related trade in gross trade:

Sector 2014 2022

Agriculture, Forestry, and Fishing 20.0 23.8

Construction 21.4 39.5

Services 25.8 27.8

Manufacturing 46.1 51.6

However, India’s participation is lower compared to countries like Vietnam, which recorded 57.0% (2014) and 62.8% (2022), or Russia with 45.4% (2014) and 42.2% (2022), whereas India stands at 41.0% (2014) and 40.3% (2022) in terms of GVC-related trade’s share of gross trade.

The “Make in India” initiative aimed to increase manufacturing activity and investments in the sector. However, manufacturing still contributes less than one-fifth of India’s GDP, a ratio unchanged since 2014. From 2012 to 2022, India’s manufacturing output per capita grew at a compounded annual growth rate (CAGR) of 5%, but countries like Bangladesh, Vietnam, and China experienced faster growth. Nonetheless, India’s manufacturing activity, especially post-pandemic, remains stronger than many of its BRICS peers.

Despite surpassing $400 billion in merchandise exports in the decade following the initiative’s launch, India’s share in global merchandise exports has remained largely stagnant.

Here is a comparison of the Index of Industrial Production (year-on-year growth in %):

Country 2019 2020 2021 2022 2023

India 0.6 -12.7 13.5 4.0 5.3

China 5.7 1.3 12.3 3.5 4.2

Vietnam 7.8 2.6 3.4 19.7 -14.3

Bangladesh 9.0 -0.6 21.0 6.9 6.2

Despite growth in the past two years, India’s manufacturing growth rate is decelerating, as evidenced by the Purchasing Managers’ Index (PMI). This slowdown comes amid global economic uncertainty and domestic challenges, both of which are eroding market confidence. Local and global demand are softening, with output and new orders—a key component of the PMI—seeing declines. India’s export market is facing challenges, and muted domestic consumption has not been able to fully compensate for weaker foreign demand. This dual pressure is a significant hurdle for manufacturers.

In summary, short-term and long-term developments in manufacturing raise concerns. India’s manufacturing share in GDP, exports, and GVC participation has not seen substantial growth, affecting economic development, inflation, and employment. For instance, India’s growth rate dropped from 7.8% to 6.7% last quarter. Despite these challenges, the fundamentals of the economy remain strong.

Manufacturing continues to hire at a slower pace, indicating that businesses are not scaling back operations just yet. While short-term challenges persist, long-term optimism remains. Looking ahead, the key challenge will be how India navigates both domestic and international obstacles. Geopolitical tensions, increasing protectionism, and the trend toward self-sufficiency pose additional challenges. Domestically, policymakers must balance stimulating growth with managing inflation and maintaining fiscal discipline. Indian companies must also enhance competitiveness and explore new markets to offset potential demand declines.

Currently, domestic manufacturing is supported by initiatives like production-linked incentives, import substitution policies, concessional corporate taxes for new units, proposals for industrial townships near major transport corridors, and policies easing logistics and land use. Additionally, there is a focus on creating a semiconductor ecosystem. However, more radical reforms are needed to boost productivity and competitiveness to accelerate growth in the sector.

India is now the world’s fifth-largest manufacturing powerhouse, producing nearly $550 billion worth of goods, which represents just 3% of global manufacturing output. Its share in gross value added remains at 17%, similar to agriculture, despite years of economic growth. Some question whether manufacturing will play its intended role in India’s growth story, especially given the country’s shift from agriculture to services without significant manufacturing dominance.

India has the potential to become the third-largest economy sooner rather than later if it continues to grow its GDP, strengthen manufacturing, and advance infrastructure. The country could add $1 trillion to its GDP every 1.5 years, reaching $10 trillion by 2032. India is on track to become a $4 trillion economy by 2024-25, making it the world’s fourth-largest economy by that time. Ten years ago, India was the 10th largest economy with a GDP of $1.9 trillion. Today, it has emerged as the fastest-growing large economy, with an 8.2% growth rate in FY24. Even with a growth rate of 6.7%, India is poised to become the third-largest economy by 2030-31.

For India to become a developed nation, it must aim to be a $30 trillion economy by 2047 with a per capita income of $18,000. This would require GDP growth of nine times its current level of $3.36 trillion and an eightfold increase in per capita income, which is currently $2,392.

The 21st century can be India’s century if it moves forward with confidence, particularly in the manufacturing sector, which has been somewhat stagnant so far. India is becoming a major player in the global supply chain, and this expanding role will be crucial to its economic growth. The manufacturing sector, supported by the right policy framework, must now lead the way in balancing supply and demand to drive the country’s progress.