Overview - Electronic and Computer Software Industry and Exports

Opportunity for Bharat -With higher tariffs on countries like Vietnam and China, Bharat could see an opportunity to gain market share in electronics and electricals by attracting global supply chains. — Vinod Johri

Recently several reports relating to fall out of US tariff rates slapped on various countries including Bharat have been published in the national and international media. It is too early to gauge the initial and final impacts on various sectors of our industry. Yet, we need to understand the strength and weaknesses of our industries while analysing the global trade constraints like the US tariff war, fear of Chinese dumping of goods in our country and consequential impact of US tariff in Europe and other countries closely associated with our country in global trade. Rather, it is imperative to watch and monitor the multiplier impact of US tariffs on global trade and on the Gross Domestic Products of various countries. Some international financial institutions are predicting recession in US economy. However, the global media looks obsessed with this issue.

There are several sectors of industry in our country and their significance in global trade and our exports in these sectors. In future, our country shall certainly have an edge in the global trade in technology sectors for which we need to evolve the new technologies in energy, electronics, computer software, ITeS, Software as a Service (SaaS), heavy engineering, space, security, missiles, textile, recycling of electronic waste, environment etc. The priority should also be given to our industry on green energy.

The present article is based on information and data of India Brand Equity Foundation and some newspaper reports.

Bharat, considered a popular manufacturing hub, has grown its domestic electronics production fromUS$ 29 billion in 2014-15 to US$ 101 billion in 2022-23. Our electronics sector contributes around 3.4% of the country’s Gross Domestic Product (GDP). The government committed nearly US$ 17 billion over the next six years across four PLI Schemes: Semiconductor and Design, Smartphones, IT Hardware and Components.

Recently, the Ministry of Electronics & Information Technology released the second volume of the Vision document on Electronics Manufacturing, which stated that the electronics manufacturing industry will grow from the current US$ 75 billion in 2020-21 to US$ 300 billion by 2025-26. The major products that are expected to drive growth in our electronics manufacturing are mobile phones, IT hardware (laptops, tablets), consumer electronics (TV and audio), industrial electronics, auto electronics, electronic components, LED lighting, strategic electronics, printed circuit board assembly (PCBA), wearables and hearables, and telecom equipment. Bharat became the second-largest mobile phone manufacturing country after China, with cumulative shipments of locally produced handsets crossing two billion during 2014-2022. The mobile phone manufacturing has surged 21 times to reach US$ 49.3 billion (Rs. 4.1 lakh crore) over the last ten years, largely due to government initiatives such as the Production Linked Incentive (PLI) scheme. This growth has enabled us to meet 97% of its mobile phone demand domestically.

The IT sector in Bharat is one of the largest contributors with a 7.5% contribution to GDP in FY23. The industry is expected to surpass US$ 300-350 billion by 2025. The Economic Survey 2023 revealed a 15.5% revenue growth for the IT-BPM sector in FY22, as against a 2.1% growth in the previous fiscal year. Our tech industry is estimated to touch US$ 254 billion in the FY24, an addition of around US$ 9 billion over previous year. Our IT industries and companies are majorly located in the southern regions such as Bangalore, Hyderabad, Chennai, Visakhapatnam, Trivandrum, Mysore, Mangalore, Kochi, etc. The country’s major information technology hubs are Mumbai, Pune, Delhi, etc.

Bharat is among the largest IT and BPM services exporting countries and accounts for about 56% of the global outsourcing market. According to a latest Crisil Ratings report, The IT services sector in the country is likely to witness a second successive year of revenue growth, at 5-7% in FY25. According to estimates by the Electronics and Computer Software Export Promotion Council (ESC), exports of computer software and services, including IT, ITeS (IT enabled services), and business process outsourcing (BPO), registered a year-on-year growth of 12.2%, reaching US$ 193 billion in the FY23. As per the National Association of Software and Service Companies (NASSCOM), the total amount of tech exports from Bharat are estimated to amount US$ 200 billion for FY24. As per Reserve Bank of India’s annual survey on computer software and information technology enabled services (ITES), exports of software services by Bhartiya companies (excluding their sales through overseas commercial presence) increased by 18.4% during 2022-23 to US$ 185.5 billion. BPO services accounted for more than 84% of exports of information technology (IT) enabled services in FY23. Business process management (BPM) exports were estimated at US$ 42.1 billion in FY22, growing 8.7% over the previous year. This growth in BPM was mainly driven by automation-led services in finance & accounts and human resources, increased adoption of robotic process automation (RPA) and analytics. BPM is also witnessing an accelerated shift to platform solutions.

Over the last few years, engineering research and development (ER&D) services have recorded one of the fastest export growths, driven by the increasing adoption of software-led products and cloudification of equipment and devices. Exports for the ER&D sector were estimated at US$ 41 billion in 2022-23. Software products witnessed 7.8% growth to reach US$ 7.3 billion, mainly driven by the rise in demand for collaborative applications, application platforms, security software, system & service management software, and content workflow & management applications.

The exports of electronic goods increased by 50.52% in FY23 to reach US$ 23.57 billion as compared to US$ 15.66 billion in FY22. Mobile phones, IT hardware (laptops, tablets), consumer electronics (TV and audio), industrial electronics and auto electronics are key export products in this sector. As per the Ministry of Electronics & IT vision, Bharat’s electronics industry exports are expected to increase to US$ 120 billion by 2026.

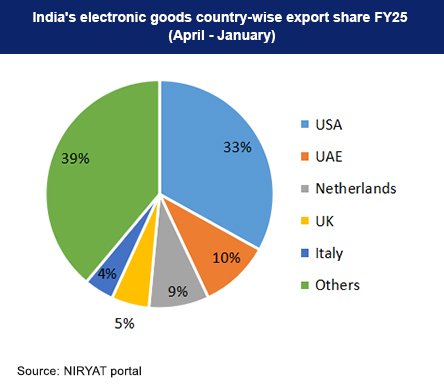

The top five destinations for Bhartiya electronic goods exports in FY25 (April-June) were: the USA, UAE, Netherlands, UK, and Italy. The USA was the largest destination of Bharat’s electronic goods exports followed by the UAE, accounting for 36% and 7% of the overall exports, respectively. For mobile phones exports from our country, South Asia, Africa, and the Middle East are key importing markets.

For the IT-ITeS services, the top three export destinations were the USA, the UK, and the EU. Our country also exports these services to Asia Pacific regions, Latin America, and Middle East Asia and sees new opportunities emerging to expand services to continental Europe, Japan, China, and Africa.

As per Reserve Bank of India (RBI) statistics, software services exports to the USA and Canada combined grew by 19.6% from US$ 86.9 billion in 2021-22 to US$ 103.9 billion in 2022-23, accounting for the largest share at 56% of the overall exports. This was followed by Europe accounting for 30.8% of the overall exports, valued at US$ 57.1 billion in 2022-23. The UK was the largest importer of our software services within Europe, accounting for 46% of exports to the Europe. Exports of our software services in Asia region were valued at US$ 12 billion, with a major share of East Asia exports valued at US$ 10.2 billion.

With the growing need for electronic goods, the Ministry of Electronics and Information Technology (MeitY) has implemented several production-linked incentives (PLI) to improve electronics production in Bharat. The government has launched schemes such as the Manufacturing of Electronic Components and Semiconductors (SPECS), Modified Electronic Manufacturing Clusters (EMC 2.0), etc., to promote the country’s electronic goods industry.

To further develop and increase the market share of the Bhartiya BPO industry, the Government has implemented schemes such as the Northeast BPO Promotion Scheme (NEBPC) and the ‘India BPO Promotion Scheme (IBPS)’.

Software Technology Parks of India (STPI) Scheme

An autonomous society under the Ministry of Electronics and Information Technology is implementing the STPI scheme, which is a 100% export-oriented scheme for developing and exporting computer software, including exporting professional services using communication links or physical media.

Apart from the above-mentioned specific schemes, the Government has taken several measures to offset infrastructural inefficiencies and associated costs to provide exporters with a level playing field. Some of these can be mentioned below.

Remission of Duties and taxes on Exported Products (RoDTEP)

Under this scheme, goods and products exporters are granted freely transferable duty credit scrips on realized FOB value of exports in free foreign exchange at a specified rate. Such duty credit scrips can be used to pay basic customs duties for importing inputs or goods.

The schemes enable duty-free import of inputs for export production with export obligation. These schemes consist of the Advance Authorization Scheme, Duty-Free Import Authorization (DFIA) Scheme, Interest Equalization Scheme (IES), Zero duty EPCG Scheme, Post Export EPCG Duty Credit Scrip Scheme, etc.

US tariffs, particularly the recent “Liberation Day” tariffs, primarily impact physical goods like electronics, textiles, and gems, but not IT services, potentially leading to increased costs for businesses and consumers, while also creating opportunitiesto gain market share in electronics from countries facing higher tariffs.

Direct Impact - The tariffs, which are 27% on our exports to the US, are primarily focused on physical goods, including electronics, textiles, gems, and jewellery, and are expected to increase the cost of these products for US consumers and businesses.

IT Services Shielded - Our IT services sector, which is a major economic driver, is largely shielded from the tariffs, as they primarily target physical goods, not service-based exports.

Indirect Impacts -While the IT services sector may not be directly impacted, there might be indirect effects as clients across sectors could postpone or slow down spending due to the broader economic impact of the tariffs.

Opportunity for Bharat -With higher tariffs on countries like Vietnam and China, Bharat could see an opportunity to gain market share in electronics and electricals by attracting global supply chains.

Source – India Brand Equity Foundation and Newspaper reports